crypto tax calculator nz

Traders Can Buy Sell Trade Cryptocurrencies All in a Single Hassle-Free Crypto Platform. When you exchange the BTC for ETH disposal of the BTC happens and you need to calculate the price difference of the BTC in NZD between when you bought it with NZD and.

Tax Credit Definition How To Claim It

Crypto tax calculators are used by crypto enthusiasts all over the world to help automate their.

. CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps. For New Zealand customers we recommend reading our 2022 NZ crypto tax guide. Some cryptoasset transactions may not have an NZD value such as.

Best crypto tax software for New Zealand Find the right crypto tax software to help do your crypto taxes in New Zealand. Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of income. The Inland Revenue service makes it clear that.

Using crypto to purchase goods or services is a taxable. All the income youve received from trading crypto assets is taxed. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

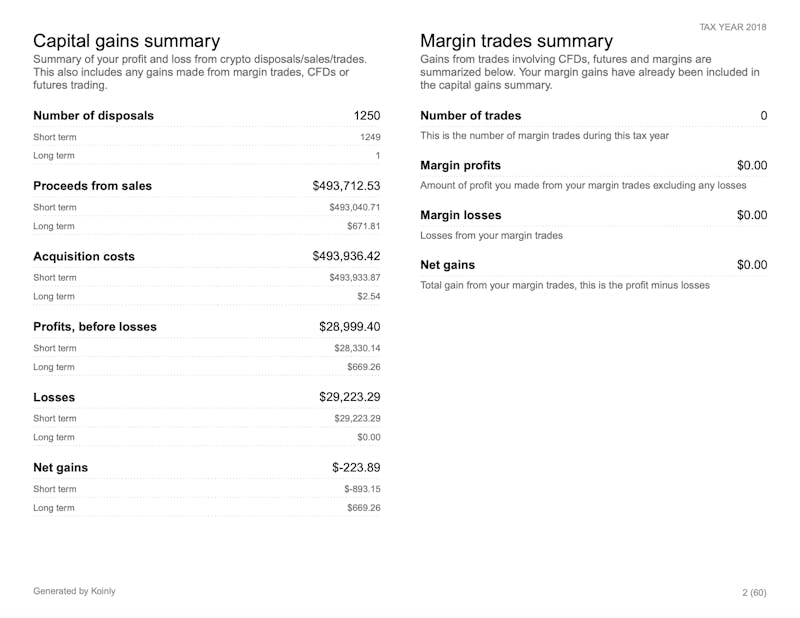

99 per tax year If you only do a small amount of trading Starter Reports are all you need. ZenLedger is another great option when it comes to cryptocurrency tax calculators. Koinly automatically imports your transactions finds all the market prices at the time of your trades matches transfers between your own wallets calculates your crypto gainslosses and.

Its very important to convert your crypto income or loss to NZD. Receiving mining or staking rewards exchanging your cryptoassets for different cryptoassets receiving a payment in cryptoassets. Exchanges Blockchain Blockchain Main Wallets Supported Main Wallets.

0325 5000. Simply copy the numbers into your annual tax return. CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps.

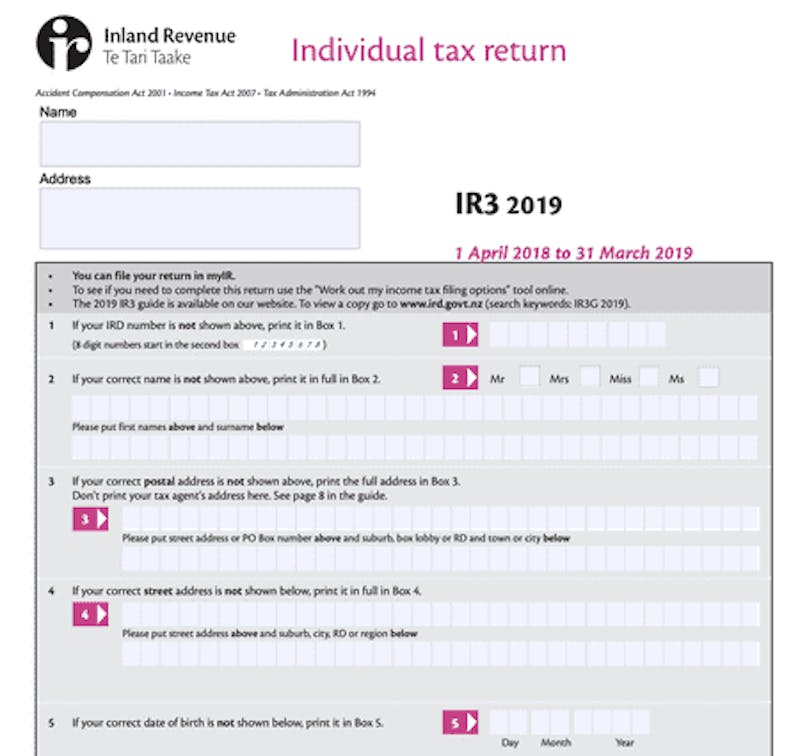

Cryptocurrency and Tax. Income from cryptoassets is subject to New Zealand tax only if the income has a source in New Zealand. After the end of the tax year 31 March you need to file an IR 3.

Done 1 supported exchange done Custom Data imports done Up to 100 trades close No mining. Taxoshi NZs Crypto Tax Caluclator. Calculating the New Zealand dollar value of cryptoassets You need to use amounts in New Zealand dollars NZD when filing your income tax return.

Get started JOIN COINPANDA Sign up for free Calculate your taxes in under 20 minutes. Check out our free and comprehensive guide to crypto taxes. Founded by the mighty Craig MacGregor co-founder of Navcoin and a legend in the NZ Crypto scene Taxoshi is a homegrown tax.

An individual earning 200000 of income per year pays total tax of 58120 or an equivalent tax rate of 291. Ad New Approved Crypto Accounts Can Receive 10 in a Supported Cryptocurrency. The second and third situation raises a key question of what is the source of income.

The platform offers you ten clients and up to 100000 transactions per client. The tax rules relating to cryptocurrency have been long been an area of confusion due to the fact that the nature of cryptocurrencies means they dont. How is your crypto asset tax calculated.

1 Add data from hundreds of sources Directly upload your transaction history via CSV or API. Filing your crypto taxes in New Zealand Koinly helps New Zealanders calculate their income from crypto trading mining etc. If you are an accountant you can also work with the Crypto Tax Calculator for 499year.

Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a taxable event. In this you include all of the income you have made in the year from all sources including wages. Crypto Tax Calculator is an Australian-based crypto tax software platform that operates with a subscription model allowing you to calculate taxes for previous tax years.

To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status. 1 Add data from hundreds of sources Directly upload your transaction history via CSV or API. Enter the price for which you.

The product can directly connect to more than 500 crypto exchanges and wallets. All plans have a 30.

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Earn More Money Free Money

Best Tool For Leverage Traders How To Use The Risk To Reward Calculator Tutorial Rewards Development

5 Best Crypto Tax Software Accounting Calculators 2022

Koinly Review And Alternatives Is It The Best Crypto Listy

Cryptocurrency Tax Reports In Minutes Koinly

Crypto Tax Calculator Review May 2022 Finder Com

Crypto Tax Calculator Review May 2022 Finder Com

Koinly Crypto Tax Calculator For Australia Nz

Cryptotaxcalculator Io Review Pricing Supported Exchanges Wallets Countries

Taxoshi New Zealand S Tax Calculator

3 Steps To Calculate Coinbase Taxes 2022 Updated

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Cryptocurrency Taxes What To Know For 2021 Money

5 Best Crypto Tax Software Accounting Calculators 2022

Cryptocurrency Tax Reports In Minutes Koinly

Capital Gains Tax Calculator Ey Us

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency